Consult guidance from industry bodies, and if you’re able to, share your expertise with your own suppliers

Invoice Fraud

Avoid being an easy target

What is invoice fraud?

Also known as mandate fraud, a fraudster poses as one of your suppliers. They tell you their payment details have changed and provide new account details. They may ask for a payment urgently. The fraud may only come to light when the genuine supplier seeks payment.

How to prevent invoice fraud

- Be cautious: Treat any request to change payment details with extreme caution. Remember that even an apparently genuine email address may have been hacked

- Verbal checks: Check the request verbally, using a trusted contact for the supplier held on file. Do not use a number included within the request as this can result in you speaking to the fraudster

- Points of contact: Consider setting up single points of contact with suppliers you pay regularly

- Staff training: Ensure staff who process invoices are trained about risks and know how to respond

- Invoice details: Compare invoice details against previous, genuine invoices. Apply the same principles to requests from within your own organisation

- Be aware of public platforms: Fraudsters may use knowledge about your supply chain, including information gleaned from your website or social media. Consider removing details such as supplier testimonials from public platforms.

What to do if you're a victim

- Act fast: For the best chance of recovering payments sent to fraudsters, be sure to act immediately. The longer you wait, the less likely you are to be reimbursed

- Report: If you have paid a suspicious invoice, contact us immediately. Our team will try to recover the money from the fraudster’s account. Call the Online Fraud Helpdesk on 0330 1565 0155

- Action Fraud: Report to Action Fraud - the police’s national fraud and cyber-crime reporting centre – even if the fraudulent attack has failed. This allows Action Fraud to monitor the general trends in fraud. Call 0300 123 2040 or file a report at actionfraud.police.uk.

Confirmation of Payee

Pay attention to Confirmation of Payee alerts. These provide instant confirmation of whether the payee name and account details you enter match those held by the bank. While this offers some protection, it is not a substitute for your own fraud defences.

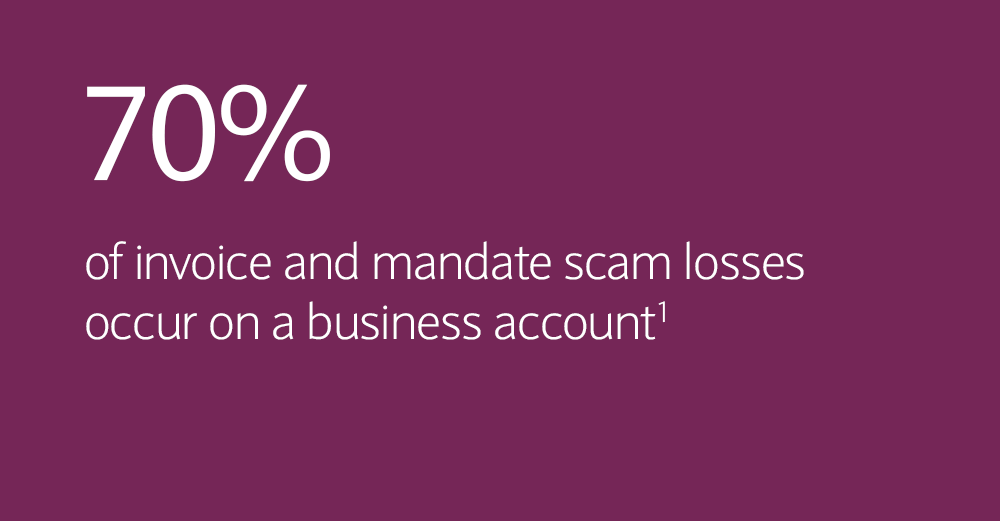

Wake up to the reality of invoice fraud

Supply chain risk checklist

Invoice fraud does not just impact a single business, it can affect the whole supply chain. Falling victim to invoice fraud may impact cashflow, liquidity and also business relationships. It is important to ensure that the other businesses within your supply chain are informed on fraud and cyber security.

Guidance and expertise

Lifecycle management

Ensure you run regular checks on your supplier’s cyber security – conduct proper lifecycle management, go and kick the tyres yourself, don’t just take their word for it

Cyber Security Accreditation

Get independent cyber security accreditation for your firm, that is regularly refreshed – giving both you and the businesses you supply additional reassurance.

Your next steps

Report fraud

To report any fraudulent activity, or attempts, contact Barclays Corporate fraud on 0330 156 0155* or if calling from overseas dial +441606566208.

If you receive a suspicious email, send it as an attachment to internetsecurity@barclays.co.uk and delete the email immediately.

Are you protected?

To keep yourself, and your organisation protected from criminals, ensure you keep up to date with our latest resources and advice.

Fraud and Scam Toolkit