Humphrey Cobbold, Chief Executive Officer, Pure Gym:

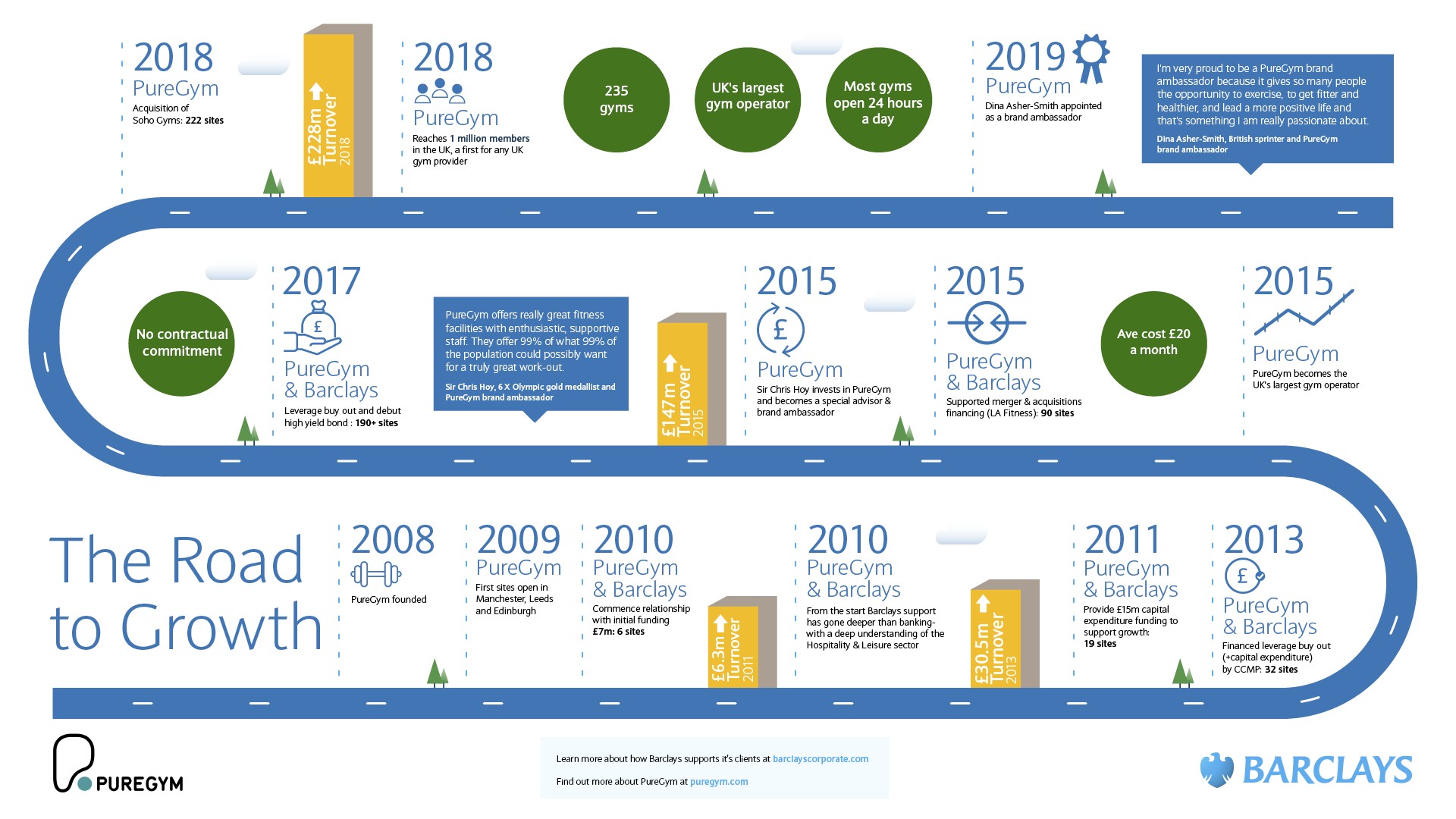

Pure Gym is the UK’s largest leisure and gym and fitness operator, we’ve got over two hundred gyms, over a million members. We were founded by an entrepreneur in the north of England in 2009, who had an idea that low cost fitness could work well in this country.

Alex Wood, Chief Financial Officer, Pure Gym:

I think the key to its success comes down to the simplicity of its business model. Pure Gym provides 99% of what our customers need for a fraction of the price of the rest of the market.

Humphrey:

Our mission is very clear, we want to inspire a healthier nation. That’s what gets us up every morning. Barclays have been one of the kind of constant sources of support for Pure Gym, right since the very early days.

Mike Delay is our relationship manager and he’s been a pretty constant feature of the relationship throughout the time. And that’s enormously important because we’ve got an individual there with, you know, great embedded knowledge and understanding of how the business works, and I think he’s come to trust us a lot as well.

Mike Delay, Relationship Director, Barclays:

We commenced a relationship with Pure Gym back in 2010 and through acquisitions of new sites and some small businesses, the business has grown phenomenally. It’s very much UK focused at the moment but they have international aspirations and we are able to support that.

Alex:

So in terms of Pure Gym’s key acquisitions, in 2015, we acquired thirty one sites from a business called LA Fitness. And secondly, more recently, we acquired ten businesses, ah, from Soho Gyms.

Mike:

Barclays support of Pure Gym I would say is threefold. One, the financing of the roll out and the growth strategy of the business over the years. Secondly, the core cash management and payments through direct debits and credit cards. And third of all, our sector involvement and expertise in the hospitality and leisure sector.

Humphrey:

In terms of innovation, Barclays have been tremendously supportive. They’re always there to guide us on trends that they can see happening in the market, but when we come up with ideas, they’re also there to fund and support us in making them happen.

Alex:

In terms of Pure Gym’s strategy for growth, the UK property market is presenting a unique opportunity for us to scale incredibly quickly, we’re aiming to double the size of the business in the next three years and of course that needs funding.

Mike:

Barclays had supported Pure Gym through multiple financings and we got to the point where we introduced colleagues from our investment bank so they could access a deeper pool of funds through the high yield bond market.

Humphrey:

I think it would be very fair to describe the relationship between Pure Gym and Barclays as a partnership; we have a very open dialogue.

Alex:

It’s a very transparent relationship, very honest and straightforward.

Mike:

I take personal pride in having supported the business from six sites through to over 200 sites as of today. I have the utmost confidence that they will deliver on their next plans and continue to grow the Pure Gym business UK and overseas.